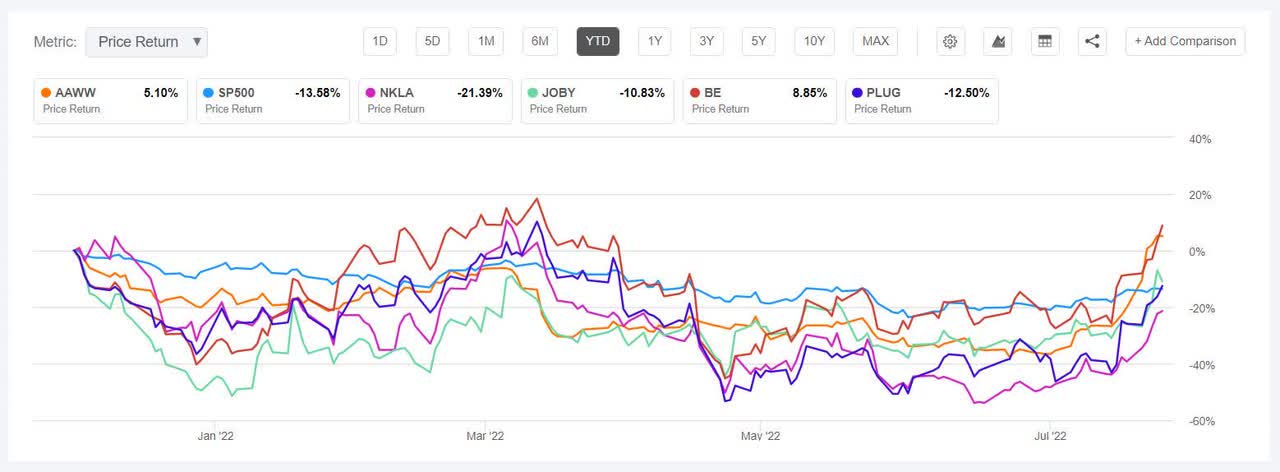

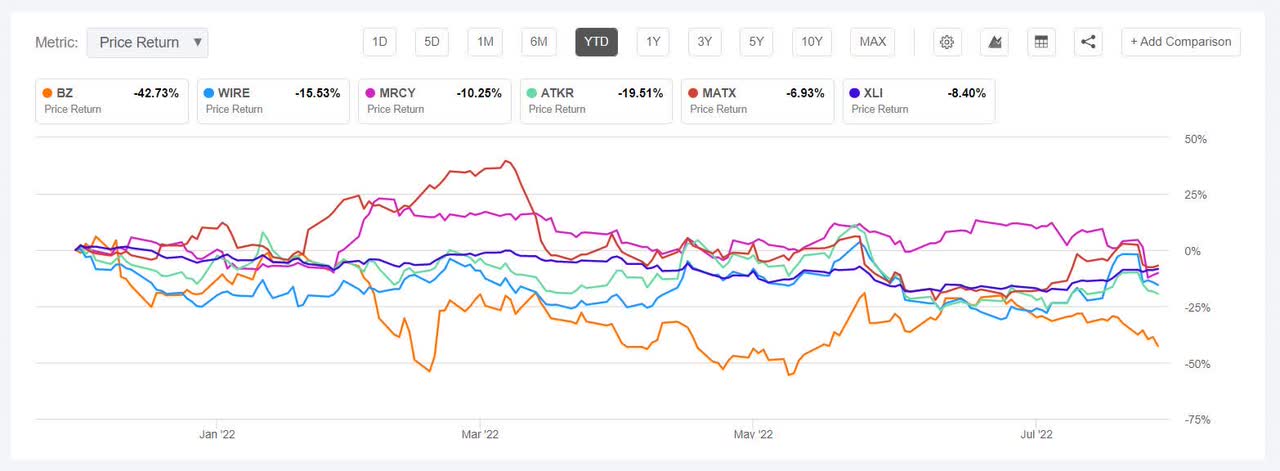

sharply_done/E+ via Getty Images While acquisition news drove the top two industrial stocks in this week's gainers, it was earnings that had a say in impacting the losing stocks, other than Kanzhun which found itself as the worst performer in the list. For the week ending Aug. 5, seven out of the 11 sectors in the S&P 500 were in the green. The S&P 500 posted its strongest monthly performance since November 2020, rising +9.11% for July. For the first week of August, The SPDR S&P 500 Trust ETF (SPY) was (+0.36%), making gains for three weeks in a row now. However, YTD, the ETF is -12.95%. The Industrial Select Sector SPDR (XLI) also rose for the third week straight and closed (+0.50%). But, YTD, XLI is in the red -9.16%. The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +18% each this week. However, YTD, only two out of these five stocks are in the green. Atlas Air Worldwide (NASDAQ:AAWW) +31.62%. The airfreight operator gained on reports that an investor group led by funds managed by affiliates of Apollo Global Management, with affiliates of J.F. Lehman and Hill City Capital were going to acquire the company for $102.50 per share in cash, at an enterprise value of ~$5.2B. The deal was officially announced on Aug. 4, the same day the company also reported its Q2 results. The SA Quant Rating on the shares is Hold, which takes into account factors such as valuation and profitability, among others things. The rating is in contrast to the average Wall Street Analysts' Rating of Buy, wherein 1 analyst each gives the stock a Strong Buy, and Buy rating, respectively while four tag it as Hold. YTD, the stock is up +5.88%, one of the only two stocks, among this week's top five gainers, which in the green for this period. Nikola (NKLA) +29.42%. The stock gained throughout the week, starting Aug. 1 (+7.88%) after announcing that it was acquiring Romeo Power in an all-stock deal. The stock also rallied on Nikola's stockholders approving the issuance of additional shares. The stock continued its momentum after Q2 results beat estimates and the company said that it was on track to deliver 300-500 production Tre BEV trucks in 2022. However YTD, the stock has shed -18.44%, and it was among the worst five industrial stocks (in this segment) in H1 (-51.82%). The SA Quant Rating on the stock is Hold, with Profitability having a factor grade of F and Growth with A+ factor grade. The average Wall Street Analysts' Rating concurs, with a Hold rating of its own, wherein 6 out of 7 analysts tag it as Hold. The chart below shows YTD price-return performance of the top five gainers and SP500: Joby Aviation (JOBY) +20.40%. The Santa Cruz, Calif.-based air taxi company's stock gained the most on Aug. 4 (+12.99%), making it to the top five gainers' list, a much better performance compared to almost two months ago when it was among the worst five decliners. The SA Quant Rating on the stock is Sell, with Profitability having a factor grade of D- and Valuation with an F factor grade. However, the average Wall Street Analysts' Rating differs and gives the stock a Buy rating, with an Average Price Target of $8.4. Bloom Energy (BE) +19.13. The stock made it to the top 5 gainers list for the second week in a row. The San Jose, Calif.-based company, which provides power generation platform, gained among solar and green energy stocks after the U.S. Senate climate and energy plan looked set for passage. The average Wall Street Analysts' Rating on BE is Buy, contradicting an SA Quant Rating of Hold. YTD, BE has risen +9.90%, the only other stock besides AAWW among this week's top 5 gainers which is in the green. Another clean energy related stock, Plug Power (PLUG) +18.04% also gained on the climate bill news but the company' shares rose the most earlier in the week (Aug. 2 +9.37%). The week also saw Plug and New Fortress Energy sign an agreement to build a 120 MW industrial-scale green hydrogen plant near Beaumont, Texas. PLUG has been in and out of the top five gainers and losers in the past one month. The SA Quant Rating on the stock is Hold, which is in contrast to the average Wall Street Analysts' Rating of Buy, wherein 14 out of 28 analysts give the stock a Strong Buy rating. YTD, the share price has fallen -10.77%. This week's top five decliners among industrial stocks (market cap of over $2B) all lost more than -9% each. YTD, all these five stocks are in the red. Kanzhun (NASDAQ:BZ) -15.19%. The Chinese online recruitment platform's shares declined the most on Aug. 1 (-7.57%).The stock continued its volatility, and was back among the decliners after three weeks. BZ gained well in June (+30%) and w among the top five (in this segment). However, the stock was among the worst five decliners in the first week of May, having made to the top in the last week of April. Similar trends were seen in March. The SA Quant Rating on the stock is Hold, with Profitability having a factor grade of B- while Valuation having a factor grade of D. The average Wall Street Analysts' Rating differs and tags BZ as Buy, wherein 7 out of 11 analysts give the stock a Strong Buy rating. YTD, Kanzhun has lost -42.83%, the most among this week's decliners. Encore Wire (WIRE) -14%. The Texas-based company's stock pared off gains it made last week following its Q2 earnings results. The stock declined the most on Aug. 2 (-12.62%). The SA Quant Rating on the shares is Strong Buy, with Growth and Valuation both having a factor grade of B+. The average Wall Street Analysts' Rating concurs and also tags it as a Strong Buy. YTD, the stock has declined -16.78%. The chart below shows YTD price-return performance of the worst five decliners and XLI: Mercury Systems (MRCY) -13.62%. The Andover, Mass.-based aero/defense products maker saw its stock dip the most on Aug. 3 (-13.34%), the day after its FQ4 results missed analysts estimates. The stock was among the worst 5 decliners two weeks ago as well. YTD, MRCY has shed -7.43%. The average Wall Street Analysts' Rating is Buy, which differs with the SA Quant Rating of Hold on the stock. Atkore (ATKR) -10.46%. The stock declined -5.88% on Aug. 2 despite the company's Q3 results surpassing analysts estimates. The Harvey, Ill.-based electrical products maker was back in the worst five decliners list after over a month. The SA Quant Rating on the stock is Strong Buy, while the average Wall Street Analysts' Rating is Buy. YTD, Atkore has fallen -20.06%. Matson (MATX) -9.47%. The Honolulu, Hawaii-based shipping company's shares slumped -8.69% on Aug 2, after at Stifel downgraded the stock despite strong earnings in Q2. The average Wall Street Analysts' Rating is Buy, while the SA Quant Rating is Hold. YTD, Matson has declined -7.82%.

Comments

0 comment