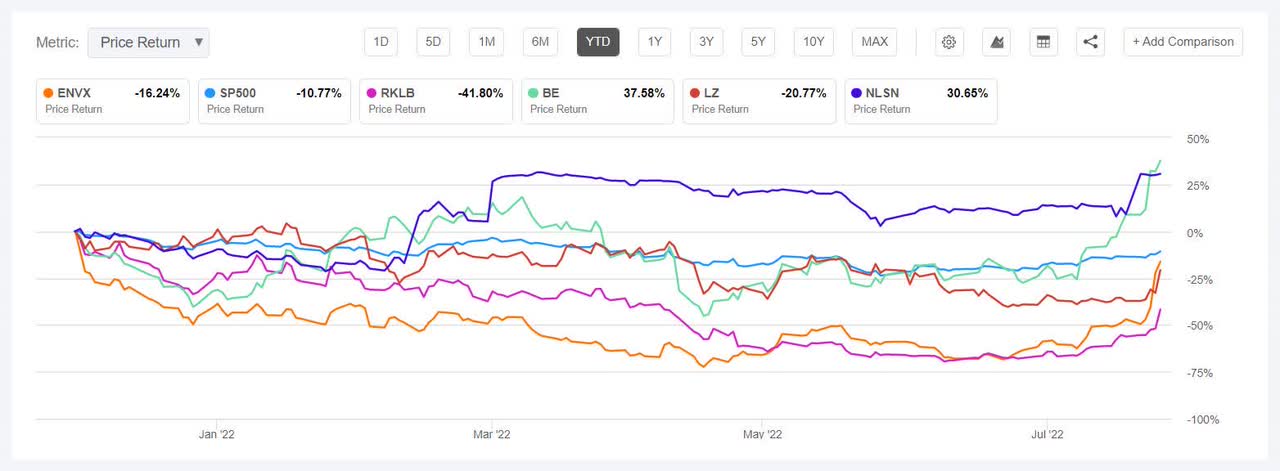

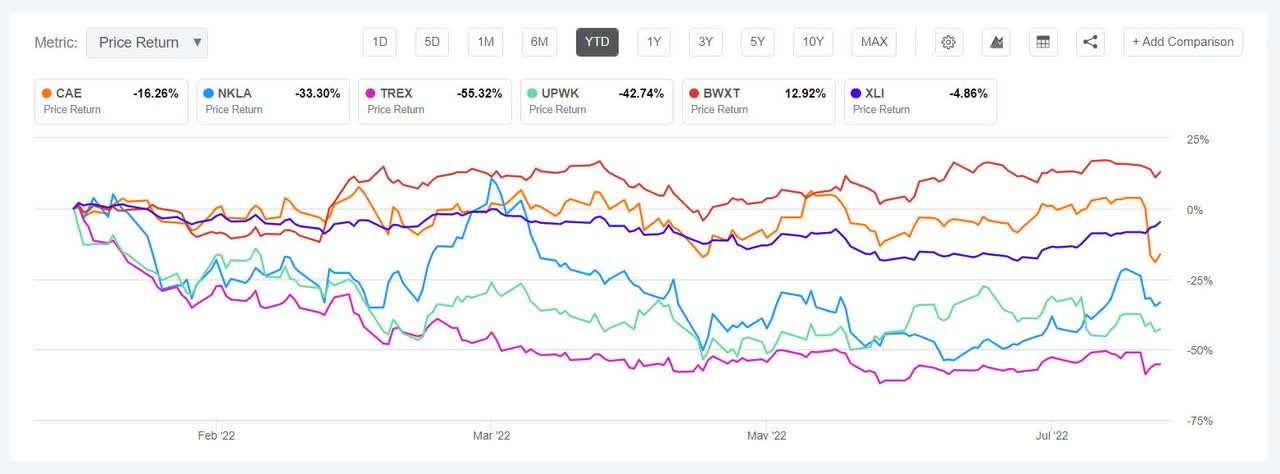

MF3d/E+ via Getty Images Earnings was the major theme this week with Enovix taking the top spot among gainers and CAE slumping to be the worst decliner. For the week ending Aug. 13, all 11 sectors in the S&P 500 were in the green with the SPDR S&P 500 Trust ETF (SPY) rising (+3.30%), making gains for four weeks in a row. However, YTD, the ETF is -10.08%. The Industrial Select Sector SPDR (XLI) also rose for the fourth week straight (+3.87%). YTD, XLI is -5.64%. The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +19% each this week. However, YTD, only two out of these five stocks are in the green. Enovix (NASDAQ:ENVX) +57.88%. The Fremont, Calif.-based lithium-ion battery maker's stock rose the most on Aug. 11 +30.84%, the day after it Q2 results, which beat analysts estimates. The stock also rallied a day prior to that after Loop Capital started coverage of Enovix with a Buy rating noting that the company could grow to be an $80B lithium battery beast. The company also got a contract to build and test custom cells for U.S. Army soldiers' central power. The SA Quant Rating on the shares is Hold, which takes into account factors such as Valuation and Profitability, among others things. The rating is in contrast to the average Wall Street Analysts' Rating of Strong Buy, wherein 5 out of 6 analysts tag the stock as a Strong Buy. YTD, the stock has fallen up -16.61%. Rocket Lab USA (RKLB) +32.96%. The stock got propelled when Bank of America mentioned it as one of its top picks at its SMID Cap 2022 Ideas Conference, and on the back of Q2 results which saw revenue soar over +391% Y/Y. BofA gives the stock a Buy rating. The average Wall Street Analysts' Rating concurs, with a Buy rating, wherein 4 out of 8 analysts tag it as Buy. However, the SA Quant Rating on the stock differs and tags it as Strong Sell, with Profitability having a factor grade of D- and Growth with F factor grade. YTD, the stock has shed -42.18%, the most among this week's top five gainers. The chart below shows YTD price-return performance of the top five gainers and SP500: Bloom Energy (BE) +26.39%. The stock made it to the top 5 gainers list for the third week in a row. The San Jose, Calif.-based company, which provides power generation platform, saw its shares climb the most this week on Aug. 10 (+18.34%), the day after its Q2 report wherein revenue beat expectations. The stock also surged to a nine-month high on Aug. 12 following a report that the company was gearing up its hydrogen electrolyzer business. YTD, BE has risen +38.90%, one of the two tocks among this week's top five which is in the green for this time period. The SA Quant Rating on the stock is Hold, with Profitability having a factor grade of D and Growth with a factor grade A. The Wall Street Analysts' Rating differs and tags the stock as Buy. LegalZoom.com (LZ) +26.17%. The Glendale, Calif.-based company's quarterly earnings surpassed analysts' estimates sending the stock skyrocketing on Aug. 12 (+18.02%). LZ, which provides an online platform for legal and compliance solutions, has an SA Quant Rating of Strong Sell, which is in contrast to the average Wall Street Analysts' Rating of Buy. YTD, LZ has shed -19.29%. Nielsen (NLSN) +19.70%. The stock rose at the start of the week after the company received governmental regulatory approvals for its $16B acquisition by a private equity consortium. YTD, the TV/Internet ratings company stock has gained +34.47%, the only other stock, besides BE in this week's top 5 which is in the green for this period. This week's top five decliners among industrial stocks (market cap of over $2B) all lost more than -2% each. YTD, four out of five of these stocks are in the red. CAE (NYSE:CAE) -19.30%. The Canadian company, which provides flight simulation equipment and training solutions, posted mixed Q1 results which sent the stock diving on Aug. 10 (-16.74%). While revenue went beyond expectations, adjusted EPS missed estimates. The SA Quant Rating on the CAE is Hold, with Profitability having a factor grade of C while Valuation having a C-. The average Wall Street Analysts' Rating differs with a Buy rating, wherein 7 out of 12 analysts give the stock a Buy rating. YTD, CAE has shed -14.50%. Nikola (NKLA) -15.16%. The stock leapfrogged from the gainers' list it found itself in last week to take a spot among the decliners this week. The electric vehicle maker's shares shed the most on Aug. 9 (-10.65%) and gained slightly at the end of the week amid vague takeover speculation. The company is also set to have a new CEO next year. NKLA was among the worst five industrial stocks (in this segment) in H1 (-51.82%), and the No. 1 decliner for Q2 and June. YTD, the stock has fallen -30.80%. The SA Quant Rating on the stock is Hold, with Profitability having a factor grade of F and Growth with A+ factor grade. The average Wall Street Analysts' Rating concurs, with a Hold rating of its own, wherein 6 out of 7 analysts tag it as Hold. The chart below shows YTD price-return performance of the worst five decliners and XLI: Trex (TREX) -8.71%. The building product maker's stock fell following its quarterly report as it guided for less capex in 2022 due to an abrupt slump in pro-channel demand during Q2. The Q2 beat was over shadowed by a downbeat 2022 guidance. YTD, TREX has lost -56.32%, the most among this week's worst five losers. The stock was among the worst five performing industrial stock (in this segment) in H1 (-59.50%). The average Wall Street Analysts' Rating for TREX is Buy, with an Average Price Target of $62.13. The rating is in contrast to the SA Quant Rating of Hold, with Growth having a D- factor grade and Profitability with a factor grade of A+. Upwork (UPWK) -6.35%. The Santa Clara, Calif.-based provider of online work marketplace was back in the decliners' list after two weeks. The SA Quant Rating on the stock is Sell, which differs with the average Wall Street Analysts' Rating of Buy. YTD, UPWK has shed -43.41%. BWX Technologies (BWXT) -2.47%. The Lynchburg, Va.-based nuclear components maker's stock made it to the decliners' list despite second quarter earnings surpassing analysts' estimates. The SA Quant Rating on the stock is Hold, which is in contrast to the average Wall Street Analysts' Rating of Buy. YTD, +14.45%, the only stock among this week's worst performers which is in the green for this time period.

Comments

0 comment