Published

on

| 9,738 views

By

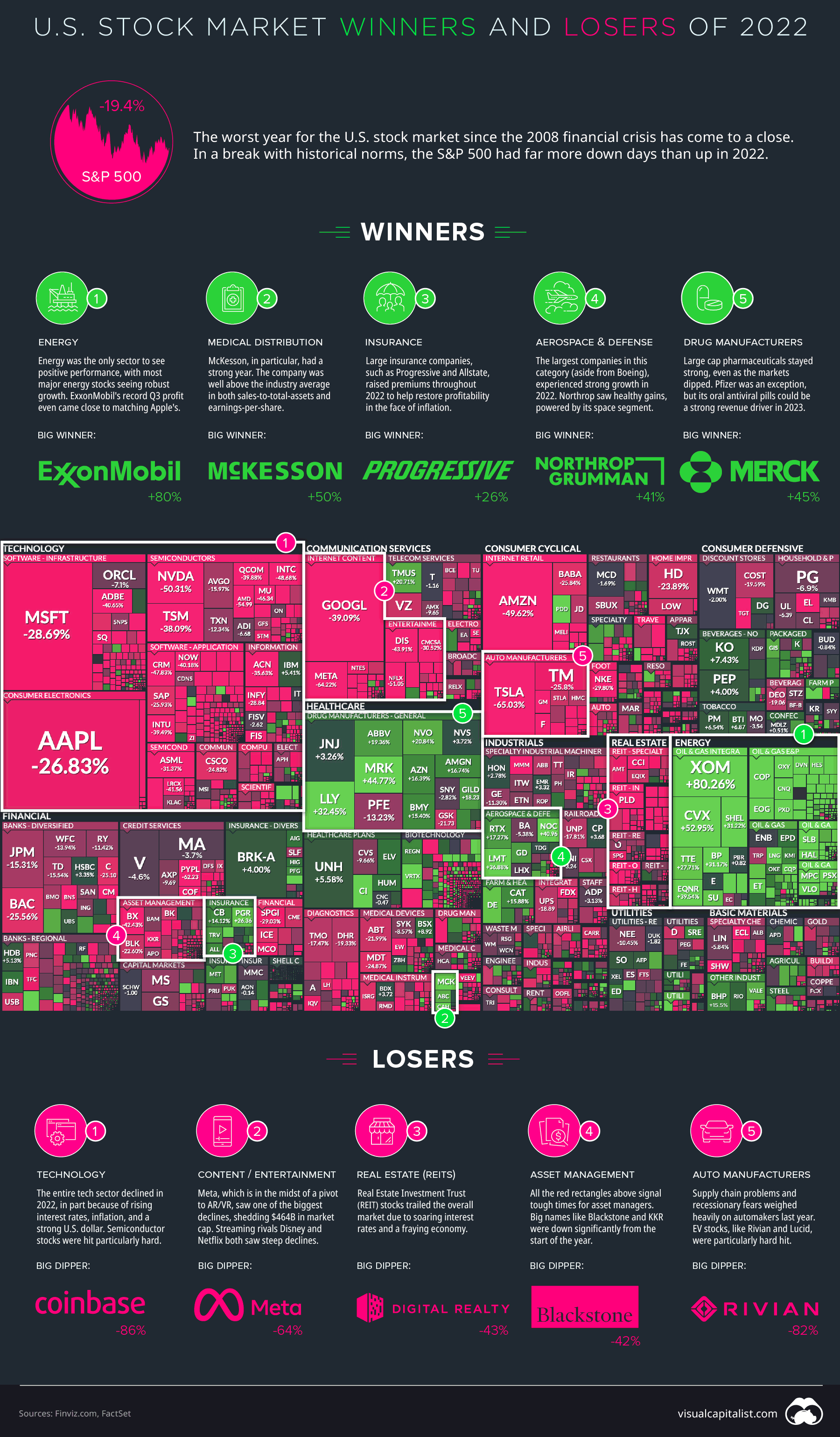

The markets in 2022 were characterized by a lot more pain than gain.

In the U.S., the Fed hiked interest rates seven times. Globally, central banks raised interest rates for the first time in years in order to combat surging inflation. The Russian invasion of Ukraine and China’s COVID Zero ambitions threw markets and supply chains into further disarray.

To recap the past 12 months, we’ve created an augmented version of the classic FinViz treemap, showing the final numbers posted for major U.S.-listed companies, sorted by sector and industry.

Below, we look closer at the majority of companies that finished the year in the red, and the few industries and companies that beat the odds and saw positive growth.

In this year’s stock market visualization, there’s a lot more red than green. That said, there were winners to be found, even during this turbulent year. Here are a few of them:

Looking at the visualization above, it’s easy to see which sector dominated this year. In fact, energy was the only sector to see positive performance, with most major energy stocks seeing double-digit growth.

In particular, ExxonMobil had a monster year. The energy giant’s record Q3 profit came close to matching Apple’s (no small feat), and the company reportedly gave out hefty salary bumps and stock options to staff. This success didn’t go unnoticed as Exxon, and industry peers like Chevron, were excoriated for setting profit records while consumers felt the squeeze at the gas pump.

The healthcare sector was a mixed bag this year, but some winners did emerge.

Large cap pharmaceutical companies managed to stay strong, even as the markets languished. Merck led the way with +45% growth this year, with Novo Nordisk, AstraZeneca, AbbVie, and Eli Lilly (+32%) also posting double-digit growth. For the latter two companies, this is a continuation of a long-term trend. Over the past decade, AbbVie is up over 600%, and Eli Lilly is up more than 800%.

Pfizer (-12%) is the notable red spot in a green industry. The company had such a strong couple of years that the decline in 2022 is not surprising. It’s worth noting that the company still has billions in cash, and its oral antiviral tab could become a big sales driver over the coming year.

The big three companies in the medical distribution industry—McKesson (+50%), Cardinal (+47%), and AmerisourceBergen (+24%)—also had a solid year.

Major defense and aerospace stocks—with the exception of Boeing—outperformed the broader market in 2022.

Northrop Grumman (+41%) saw healthy gains, powered by its space segment. The company will be busy building rocket boosters that will help put Amazon’s 3,000+ communications satellites into orbit in coming years.

Lockheed Martin (+38%) capped off a strong year with a cool half a billion dollar contract from the U.S. Government.

2022 was the worst year for the S&P 500 since the 2008 financial crisis. While the markets usually finish up, down years can happen. Last year was one of those rare times.

Unlike the winning side of the equation, there’s no lack of material to cover in this section. We’ve scanned the sea of red for sectors to dig into.

The tech sector, from semiconductors to software, saw steep declines across the board last year.

The list below, which shows the largest declines in the S&P 500, puts into perspective just how much value was wiped out in the tech sector this year.

In absolute terms, Apple is the biggest loser on the year, shedding $846 billion from its market cap. Meta, which is in the midst of building out its vision for a “metaverse”, also saw one of the biggest declines, shedding $464 billion in market cap.

Semiconductor stocks, like NVIDIA (-50%) and TSMC (-38%) were hit particularly hard.

The so-called crypto winter, collapse of NFT transactions, and even bigger collapse of FTX, spelled tough times for any company that specialized in crypto. Although Coinbase avoided any major controversies last year, its stock was still hammered, falling 86% on the year.

Last year posed many challenges for U.S. automakers.

Macroeconomic issues aside, simply being able to roll new vehicles off the assembly line proved to be a challenge as supply chain issues persisted.

Tesla saw 40% growth in deliveries last year, but that was not enough to satisfy investors. The automaker’s stock has been plummeting since September, and eventually finished down 65% on the year.

Other pure-play EV companies fared even worse. Rivian and Lucid saw massive 90%+ declines over the course of last year.

Real Estate Investment Trust (REIT) stocks trailed the overall market due to soaring interest rates and uncertain economic circumstances.

This was in stark contrast to 2021, when REITs had one of their best-ever performances.

Though most of this sector is made up of REITs, WeWork is also in the mix. The previously high-flying company saw one of the steepest declines, finishing the year down more than 80%.

Many experts believe that a recession is coming, with severity and duration being the main topics of debate.

Other questions remain as well. Will the tech sector continue mass layoffs going into 2023? Will supply chain issues persist? Will offices slowly spring back to life, or has remote work drastically altered the commercial real estate equation? Will the conflict in Ukraine continue, or come to a resolution?

If there’s one thing we’ve learned over the past three years, it’s that predicting the future is anything but easy.

Top Heavy: Countries by Share of the Global Economy

All of the World’s Money and Markets in One Visualization (2022)

Where Does the World’s Ultra-Wealthy Population Live Today?

A Visual Guide to Stock Splits

How Every Asset Class, Currency, and S&P 500 Sector Performed in 2021

The U.S. Stock Market in 2021: Best and Worst Performing Sectors

Who are the Longest Serving Active CEOs in the S&P 500?

Just five countries make up more than half of the global economy. The top 25 countries make up a staggering 84% of the world’s GDP.

Published

on

By

As 2022 comes to a close we can recap many historic milestones of the year, like the Earth’s population hitting 8 billion and the global economy surpassing $100 trillion.

In this chart, we visualize the world’s GDP using data from the IMF, showcasing the biggest economies and the share of global economic activity that they make up.

The global economy can be thought of as a pie, with the size of each slice representing the share of global GDP contributed by each country. Currently, the largest slices of the pie are held by the United States, China, Japan, Germany, and India, which together account for more than half of global GDP.

Here’s a look at every country’s share of the world’s $101.6 trillion economy:

Just five countries make up more than half of the world’s entire GDP in 2022: the U.S., China, Japan, India, and Germany. Interestingly, India replaced the UK this year as a top five economy.

Adding on another five countries (the top 10) makes up 66% of the global economy, and the top 25 countries comprise 84% of global GDP.

The rest of the world — the remaining 167 nations — make up 16% of global GDP. Many of the smallest economies are islands located in Oceania.

Here’s a look at the 20 smallest economies in the world:

Tuvalu has the smallest GDP of any country at just $64 million. Tuvalu is one of a dozen nations with a GDP of less than one billion dollars.

Heading into 2023, there is much economic uncertainty. Many experts are anticipating a brief recession, although opinions differ on the definition of “brief”.

Some experts believe that China will buck the trend of economic downturn. If this prediction comes true, the country could own an even larger slice of the global GDP pie in the near future.

Where does this data come from?

Source: IMF (International Monetary Fund)

Data note: Due to conflict and other issues, some countries are not included in this data set (e.g. Ukraine, Syria, Afghanistan). Major sources for GDP data differ widely on the size of Iran’s economy. It’s worth noting that this data from IMF ranks Iran’s GDP much higher than World Bank or the UN.

Ranked: The 100 Biggest Public Companies in the World

Visualizing Currencies’ Decline Against the U.S. Dollar

Bonus Gift: Get our ‘Best of VC+ in 2022’

The Rising Demand for Nature-based Climate Solutions

Charted: The Ukraine War Civilian Death Toll

Top Heavy: Countries by Share of the Global Economy

Mapped: Which Countries Have the Highest Inflation?

Mapped: The Most Innovative Countries in the World in 2022

Comments

0 comment