Stocks closed higher Thursday after December's consumer price report showed inflation cooled for the month, raising hopes the Federal Reserve can once again slow interest rate hikes.

The Dow Jones Industrial Average gained 216.96 points, or 0.64%, to close at 34,189.97. The S&P 500 added 0.34%, to end at 3,983.17.

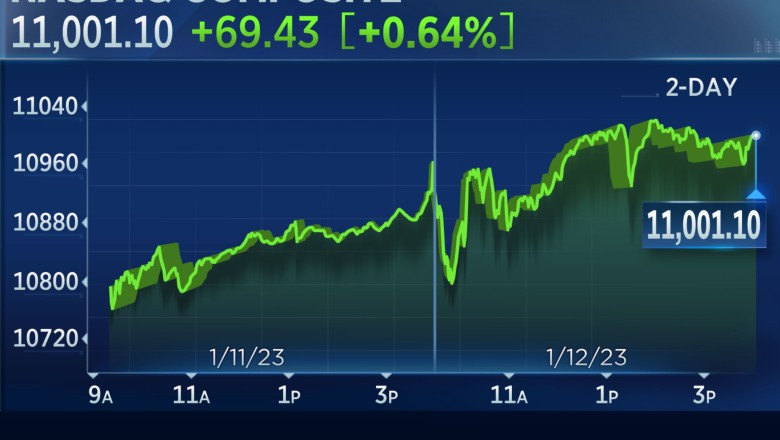

The Nasdaq Composite closed up 0.64% at 11,001.10, marking a five-day winning streak. That's the first rally of that length the technology-heavy index has seen since July.

The Nasdaq is on pace for the biggest weekly increase of the three indexes, gaining 4.1% so far as investors picked up beaten-down growth stocks ahead of the CPI report. The S&P 500 and Dow are also poised for weekly advances of roughly 2.3% and 1.7%, respectively.

December's CPI report showed a 0.1% dip in prices from November, but prices were still 6.5% higher than the prior year. That's in line with what economists polled by Dow Jones expected. In November, the report showed a 0.1% monthly gain and an annual pace of 7.1%.

The CPI excluding food and energy prices was also in line with expectations, showing a month-over-month gain of 0.3%. The so-called "core" index was 5.7% higher in December than a year ago.

"I think the markets are pleased, but they don't seem to be overly excited," said Sandi Bragar, chief client officer at Aspiriant, of the reaction to the CPI report. "Any news in the right direction can make the markets happy these days."

Stocks have rallied in recent sessions as investors bet the CPI report would confirm a weakening inflation trend. Investors in recent months have watched for data signaling cooling inflation in hopes it would give the Fed justification for further slowing interest rate hikes.

Boston Fed President Susan Collins said in an interview with the New York Times Wednesday that she's leaning toward a smaller, quarter-percentage-point rate hike at the next meeting. On Friday, investors will parse remarks scheduled to be given by Collins and two other senior Fed officials.

Big banks including JPMorgan, Bank of America, Citigroup and Wells Fargo are set to report quarterly earnings Friday. Delta Air Lines is also slated to report.

Lea la cobertura del mercado de hoy en español aquí.

Stocks ended Thursday's trading session in the green.

The Dow and Nasdaq Composite each ended up 0.6%. The S&P 500 gained 0.3%.

Close marked the fifth straight day of gains for the Nasdaq as investors bought beat-up technology stocks on hopes of an improving outlook for growth names. That's the first time the index has posted a streak of that length since July.

— Alex Harring

Bed Bath & Beyond jumped more than 60% Thursday as meme stocks remain a focus of investors looking to short this week.

CNBC Pro subscribers can read more about the latest squeeze and what it means for Wall Street.

— Samantha Subin

Retail traders unloaded $746 million worth of Tesla shares over the past week, bringing the total outflow over the last three weeks to $2.1 billion, according to data from JPMorgan.

It comes even as investors piled back into stocks, buying $1.2 billion worth of equities in the past week. That included $157 million of Amazon shares and $102 million of Apple. Retail traders dumped just $19 million worth of single stocks during the period.

"Selling was largely concentrated within Autos (mostly TSLA) with broad based buying in other industries including Retailing (e.g., AMZN, HD), Media/Entertainment (e.g., GOOGL, NFLX, CMCSA) and Tech Hardware/Equipment (mostly AAPL)," the firm said.

— Samantha Subin

Major bank stocks are experiencing a calm session on Thursday ahead of a flurry of earnings reports that begin on Friday morning.

Among the banks reporting tomorrow, Citigroup is the day's best performing stock, adding 1.1%. JPMorgan Chase, Bank of America and Wells Fargo are all up less than 1%.

Looking ahead to next week's reports, shares of Goldman Sachs are up 1%, and Morgan Stanley has gained nearly 2%.

— Jesse Pound

With one hour of trading left, the three major indexes remain on pace for daily gains.

The Dow is up 0.7%. The Nasdaq Composite and S&P 500 follow, gaining 0.6% and 0.5%, respectively.

If the Nasdaq closes up, it would be the first five-day rally for the technology-heavy index since July.

— Alex Harring

Carvana was the latest stock being short squeezed, surging 35% in afternoon trading.

Shares fell 98% in 2022 as the used car platform faced growing threats of bankruptcy. With the 35% daily jump, a share now trades at around $7.40. That's nearly 92% off where the stock ended 2019 and 96% down from where it ended 2020.

Meme stocks including AMC Entertainment and Bed Bath & Beyond have also made unprompted jumps this week.

— Alex Harring

The cost of financing a home purchase slipped further this week.

The average interest rate on a 30-year fixed-rate mortgage inched down to 6.33%, a decline from the prior week's average rate of 6.48%, according to data from Freddie Mac. Meanwhile, rates on 15-year loans are averaging 5.52%, slipping from last week's average level of 5.73%.

Though the rates on these loans are ticking lower, they are still high compared to where they 12 months ago – before the Federal Reserve began its rate hiking campaign in earnest. A year ago, the average rate on a 30-year mortgage was 3.45%, and it averaged 2.62% on 15-year loans.

— Darla Mercado

Advancers held a clear advantage over decliners Thursday, as the major U.S. stock benchmarks rallied following the latest inflation data report.

More than 2,100 New York Stock Exchange-listed names traded higher, while just 786 declined, according to FactSet. In other words, advancers led decliners roughly 3-1.

— Fred Imbert

Eight of 11 S&P 500 sectors traded up Thursday.

Energy led the way gaining 2.1%. Real estate and communication services came in at the second and third best performers, each up 0.9%.

On the other hand, consumer staples was on track for the worst daily performance, dipping 0.6%. Health care and utilities were the other two in the red, each shedding 0.2%.

— Alex Harring

These are the stocks making the biggest midday moves:

Check out our full list for further details and more big movers.

— Tanaya Macheel

After a topsy-turvy morning, stocks traded up.

The Dow traded up 290 points, or 0.8%. At its highest, the 30-stock index advanced 0.9%. It traded down as much as 0.5% as investors initially responded to the CPI data.

The S&P 500 was up 0.5%. That's close to its largest gain of the day at 0.6% and far from the low, at which point the broad index slipped 0.8%.

The Nasdaq Composite gained about 0.5%, fractionally off session highs. At its lowest point, the index lost 1.2%.

— Alex Harring

With the CPI in line with economists' expectations, investors will now turn to Fed speakers with events on Thursday and Friday for insights into future interest rate moves, according to Huw Roberts, head of analytics at Quant Insight.

Richmond Fed President Tom Barkin is the only speaker who has yet to start their comments Thursday. He'll be at a financial forecasting event held by the Virginia Bankers Association and Virginia Chamber of Commerce. His remarks are scheduled to start at 12:40 p.m.

Here's who's on the docket for Friday:

On Wednesday, Collins told the New York Times she was leaning toward a 0.25% interest rate hike at the next meeting.

— Alex Harring, Betsy Spring

Bernstein is maintaining its underperform rating on shares of electric vehicle maker Tesla, even as the Inflation Reduction Act is set to offer tax credits for clean vehicles.

"While the interim rules are clearly positive for demand, the prevailing uncertainty around EV subsidies is not optimal," wrote Neil Beveridge in a Thursday note. "With significant order backlog and demand largely dictated by supply, it is unclear how stimulative interim rules might be. Moreover, rebates are credits to tax returns (>1 year away)."

In addition, the initial classification of Tesla's Model Y as an automobile even though it has at least five seats was a negative surprise, he said.

"US Model Y today accounts for ~50% of US sales and 23% of global sales. 80%+ of Model Y units are 5-seaters, which will not qualify for EV credits unless Tesla lowers price or consumers spend an incremental $3000 for the 7-seater," said Beveridge.

Tesla's SR Model 3 will initially qualify for the discount, but it makes up only 15% of U.S. sales and about 7% globally. The company's battery manufacturing should qualify for production credits but may have to share with Panasonic.

"We are more torn on TSLA's stock, given its recent pullback. On one hand, the stock is now trading at close to our 2050 DCF (~ $120/share) and investor sentiment is horrible," said Beveridge. "That said, we believe that many investors underestimate the magnitude of the demand challenges Tesla is facing, and that 2023/24 numbers could materially reset."

He is also worried about the potential for broader market pressure, higher rates and slower consumer spending weighing on the stock.

—Carmen Reinicke

Evercore ISI downgraded Hewlett Packard Enterprise to in line from outperform on Wednesday.

Among the reasons the Wall Street firm cited were moderating IT spending and tighter budgets this year, as well as server revenues moderating from its double-digit momentum last year.

"We think 2023 is evenly balanced between a relatively optimistic full year guide (supported by a healthy backlog) and macro uncertainty impacting IT spend as well as AUP growth moderating (servers in particular)," analyst Amit Daryanani wrote in a note.

Shares ended 2022 slightly higher and are up nearly 4% so far this year.

— Michelle Fox

Shares of Cinemark have shed more than 30% in recent weeks but are poised to outperform following the success of "Avatar," according to JPMorgan. That makes now a great time to snap up shares.

JPMorgan upgraded Cinemark to overweight from neutral and kept its $15 price target, which implies a more than 57% upside from where the stock currently trades. Shares rose 2.5% in premarket trading on the news.

"Following a 31% decline in shares since the beginning of December (vs. SPX -3%), we believe the risk/reward is more favorable to take a positive view on the stock," wrote analyst David Karnovsky in a Thursday note.

CNBC Pro subscribers can read more here.

—Carmen Reinicke

2023 is just kicking off, but some restaurant stocks have already posted double-digit year to date increases.

Many popular restaurant names in the S&P 1500 have broken past their 50-day moving averages, settling into overbought, and, in some cases, extreme overbought territory, according to data compiled by Bespoke Investment Group.

Some overbought names include Bloomin' Brands, Cheesecake Factory, Dave & Buster's and Brinker International, with shares up more than 15% each.

Shake Shack shares have risen the most among the group of stocks, with shares surging more 29% since the start of 2023 after falling about 42% in 2022.

— Samantha Subin

Shelter costs, which includes rent, jumped more than expected in the December consumer price index, and that is an area economists are watching closely.

Shelter rose 0.8%, or 7.5% from a year ago. Some economists had expected a gain of 0.6% in shelter, which accounts for 40% of core CPI. The shelter costs in CPI are known to lag the actual market data on rentals.

"In this single month-over-month report, there is almost no inflation outside of shelter," said Wilmington Trust chief economist Luke Tilley "Goods prices are collapsing mostly because of motor vehicles and computers and laptops and technology. Used vehicle prices are down 27.5% at annualized rate over the past three months, and they're likely to keep falling."

Tilley expects shelter inflation to slow in the next couple of months. As for overall CPI, it fell by 0.01% as expected.

Greg Peters, co-chief investment officer of PGIM Fixed income, said the increase in shelter inflation is something to watch. He said the market had expected a slightly larger decline in headline CPI.

"I still think it's largely fine. I think numbers will continue to come down. The real question is where does it start to level out?" said Peters. "That's the piece of it that should be the point of focus. It's great that CPI mechanically is coming down, and there's some good news in the report. But that doesn't mean the Fed gets close enough to its target that they get comfortable."

Tilley said he expects 2023 will be unlike 2022, where inflation surprised to the upside. "We very well could see in 2023 the reverse of what happened in 2022 with inflation surprising to the downside," he said.

--Patti Domm

Philadelphia Federal Reserve President Patrick Harker said he thinks the central bank can ease back further on interest rate increases.

"I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed. In my view, hikes of 25 basis points will be appropriate going forward," the central bank official said in a speech Thursday morning.

"At some point this year, I expect that the policy rate will be restrictive enough that we will hold rates in place to let monetary policy do its work," he added.

A basis point is 0.01 percentage point.

The comments came prior to a Labor Department report showing that the consumer price index declined 0.1% in December, adding to some positive inflation readings late.

Harker is a voting member this year on the rate-setting Federal Open Market Committee.

—Jeff Cox

The three major indexes jumped around in the first minutes of trading Thursday as investors continued digesting the CPI data.

At 9:35 a.m., the Dow was down 0.1%. The S&P 500 also shed 0.1%, while the Nasdaq Composite lost 0.2%.

All three indexes opened up at 9:30 a.m.

— Alex Harring

While headline and core CPI readings for December showed monthly moves of -0.1% and 0.3%, respectively, there was a wide divergence among some of the internal components.

Here's a look at the month-over-month changes in key categories:

Shelter inflation is a key area of debate, as investors and analysts who think the Fed is being too aggressive argue that shelter data is outdated.

—Jesse Pound

The major futures indexes whipsawed as investors responded to December's CPI data, which came in in line with economist expectations. See how each of the three futures indexes moved in the 30 minutes leading up to and following the release of the data at 8:30 a.m. ET:

— Alex Harring

The slight decline in consumer prices in December will not change the path for the Federal Reserve, as it meets to raise rates Jan. 31 and Feb. 1.

CPI fell by 0.01%, as expected by economists, and was up 6.5% from a year ago. Core CPI rose 0.03%, also as expected.

"The Fed has made clear even as markets push back on the Goldilocks scenario in the employment report, the Fed was doubling down on their pledge to derail inflation because they see this as a marathon not a sprint," said Diane Swonk, chief economist KPMG.

Stock futures were higher after the report while Treasury yields fell. Yields move opposite price.

"It was exactly in line. They ran up the S&P 500 by 50 points yesterday with everyone hoping for a weak number. It was as expected. It doesn't change anything," said Peter Boockvar, chief investment officer at Bleakley Financial. "They are almost done raising rates. Higher for longer is what people should be focused on."

Swonk and other economists expect the Fed to raise rates by a half percentage point on Feb. 1. The futures market, however, has been pricing in a quarter point hike.

--Patti Domm

The consumer price index fell 0.1% in December, matching a Dow Jones estimate. That was the biggest monthly decline since April 2020. The so-called core CPI, which strips out volatile food and energy prices, also met expectations with a 0.3%. gain.

On a year-over-year basis, the index rose 6.5%, still well above the Fed's 2% inflation target.

— Fred Imbert

These are some of the stocks making the biggest moves before the bell:

Disney – Disney shares added more than 1% in early morning trading after the company elected independent director Mark Parker as Chairman of the board. It also opposed activist investor Nelson Peltz's attempt to join the board as the two sides prepare for a proxy battle.

American Airlines — The airline gained 5% after the company lifted its fourth quarter guidance, citing strong demand and high fares.

Bed Bath & Beyond — The retailer advanced 16% premarket, continuing to rally after a handful of meme stocks surged Wednesday. The stock surged almost 69% in Wednesday's session.

Read the full list of stocks moving premarket here.

— Samantha Subin

The big move in Bed Bath & Beyond on Wednesday may not have been a short-squeeze yet, but that could come soon, according to Ihor Dusaniwsky of S3 Partners.

The stock spiked more than 68% to $3.49 per share on Wednesday. It has continued to climb higher in extended trading, pushing above $4 per share.

"We could see some near-term short sellers exit their positions and begin to pocket (realize) the profits they earned in 2022," Dusaniwsky said.

Bed Bath & Beyond has short interest of about 52%, according to S3. While those who began this trade in the last month may be sitting on losses, the stock did trade as high as $30 per share in August — meaning others may be comfortably able to ride out a process that may end in bankruptcy.

"The crucial difference between BBBY and other crowded shorts is that there is a definite threat of bankruptcy, which could embolden shorts to hold onto their positions, incur some temporary losses, and wait out this rally in anticipation of a $0.00 stock price in bankruptcy," Dusaniwsky said.

— Jesse Pound

Jefferies upgraded Netflix to buy from hold, citing a potential increase in revenue as the streaming giant cracks down on password sharing. The stock gained 1.3% in premarket trading.

"We're upgrading Netflix to buy based our belief that a well-executed strategy of launching [advertising-based video on demand] with password sharing changes will drive revenue and adjusted EBTIDA well above Street estimates, resulting in margin upside and valuation expanding back towards historical averages," Jefferies said.

— Carmen Reinicke

American Airlines shares rose 3% in the premarket after the airline hiked its fourth-quarter earnings guidance. The company now expects earnings for the quarter to come in between $1.12 and $1.17 per share, up from a previous range of 50 cents to 70 cents.

— Fred Imbert

Cleveland-Cliffs shares rose more than 2% in the premarket after Morgan Stanley upgraded the steel producer to overweight from equal-weight, citing a boost from higher fixed annual steel price contracts.

"We believe the recently announced increase in fixed annual steel price contracts (see here) should allow CLF to cope with lower forecast spot steel prices and generate robust FCF yields in the coming years as the company has no major planned capital expenditures," analyst Carlos De Alba wrote in a note.

— Carmen Reinicke

European markets were higher on Thursday as global investors geared up for the December reading of U.S. consumer prices.

The pan-European Stoxx 600 index was up 0.5% in early trade, with telecoms adding 0.9% to lead gains as all sectors and major bourses entered positive territory.

- Elliot Smith

Shares of Disney rose 1.5% in after-hours trading after the media giant announced that it has named Mark Parker, the executive chairman of Nike, its next chairman of the board.

Disney also said that it is opposing activist investor Nelson Peltz's attempt to join the board. Nearly two months ago, Peltz's Trian Fund Management took an approximately $800 million stake in the company and began seeking a board seat.

— Yun Li

It might be too soon to cheer the the early signs of inflation easing as services inflation could keep price pressures elevated, according Andrew Patterson, Vanguard's senior economist.

"The main upside risk to core inflation comes from the ex-shelter services components," Patterson said in a note. "Persistent wage growth could keep services inflation running hot in 2023. Recent slowing in wages while welcome, does not yet suggest a broader slowing of labor market."

While goods deflation is a welcome sign, we would still need two more ingredients to call peak inflation —a slowing labor market and persistently cooling shelter inflation, Patterson said.

— Yun Li

Got a confidential news tip? We want to hear from you.

Sign up for free newsletters and get more CNBC delivered to your inbox

Get this delivered to your inbox, and more info about our products and services.

© 2023 CNBC LLC. All Rights Reserved. A Division of NBCUniversal

Data is a real-time snapshot *Data is delayed at least 15 minutes. Global Business and Financial News, Stock Quotes, and Market Data and Analysis.

Comments

0 comment